Content

There are required institute coursework hours that a person needs to complete with specific hours in accounting, auditing, taxation, and business core classes. Even after receiving the license, the CPA will have to continue taking education classes to stay updated with the new information and changes in accounting. There are primary functions that accountants and CPAs have to conduct. The primary functions that a CPA has to conduct are carrying out assurance services or public accounting. CPAs attest to financial statements in the assurance service category.

CPAs can only perform this audit, and only they can issue the required reports. CPAs are the only person who holds the legal duty and power on behalf of their clients. Whereas, the accountants are not considered to behold the fiduciary responsibilities to their clients.

Maintaining a CPA License

While in-house audits may be completed by an accountant, external audits or auditing of public companies is always handled by a CPA. Both the profession of accountants and the CPAs are best in their own place. It is now according to your cost and priority you should choose the best option for yourself. Both of them have their pros and cons, choose according to which fits best with your priorities. To choose the best accounting services in Edmonton, you should call ATS Accounting & Tax Edmonton or contact us online. Ageras is an international financial marketplace for accounting, bookkeeping and tax preparation services.

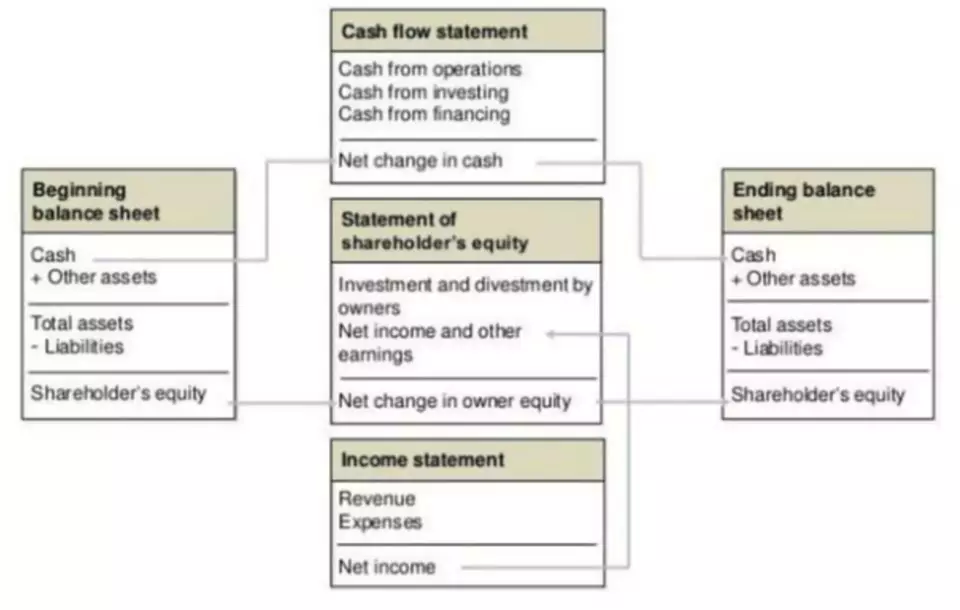

Accounting, AuditingAccounting is recording, maintaining and reporting the financial affairs, depicting the precise financial position of the company. In contrast, auditing is the systematic examination of accounts books and other documents to check whether the statement shows the correct information or not.

CPA vs Accountant: Which Is Better?

Can call themselves an accountant, even without a professional degree in accounting, although usually, an accountant does have an accounting-related degree. Accounting as a system tries to identify, assess and record the transactions of financial nature in a very systematic approach.

As a CPA, you have your choice of firms—from large international firms to small, local accounting practices. CPAs also commonly work in government agencies or public companies required to disclose audited financial information. CPAs are licensed professionals, which requires them to adhere to more stringent standards than unlicensed accountants.

Resources for Your Growing Business

Most accountants hold a bachelor’s degree with some training and experience to perform a wide range of accounting work for a business. Accountants at Edmonton accounting firms normally handle work like financial reporting, auditing, internal control, risk assessment, costing cpa vs accountant budgeting, and performance management. CPA candidates need at least a bachelor’s degree related to finance and accounting to apply for the exam. They need to pass rigorous testing and strict requirements for licensing in the state in which they intend to practice.

Some accountants focus on business management accounting, which helps organizations leverage company performance metrics and other data to make business decisions. Others become a Certified Fraud Examiner and help businesses and government agencies prevent, detect, and investigate fraud. Some work as financial advisors to help high-net-worth individuals manage their financial affairs. There’s really a wide variety of specializations for both accountants and CPAs. Typically, an accountant has achieved a bachelor’s degree in accounting. A certified public accountant earns this designation after completing specific educational and work requirements and passing a CPA exam.